If you’re a single parent like me, you know the hustle is real. Between packing lunches, school runs, working (sometimes two jobs), and remembering which kid hates broccoli this week—budgeting can feel like one more thing that wants your soul.

But here’s the deal: you don’t have to be a finance guru to make ends meet. You just need a few real-life hacks that actually work.

This one’s for all the single parents, single moms, and side-hustling superheroes out there who are chasing financial stability while holding down the fort solo.

I’ve been there, I’m still there, and I promise—it is possible to manage your money without sacrificing your joy, coffee, or sanity.

Ready for a single mom budget game plan that doesn’t feel like punishment? Let’s talk hacks. The kind you can do without a spreadsheet-induced meltdown.

1. Create a “Zero-Based Budget”—But Make It Fun(ish)

Look, I get it. “Zero-based budget” sounds like something your accountant uncle talks about at family gatherings.

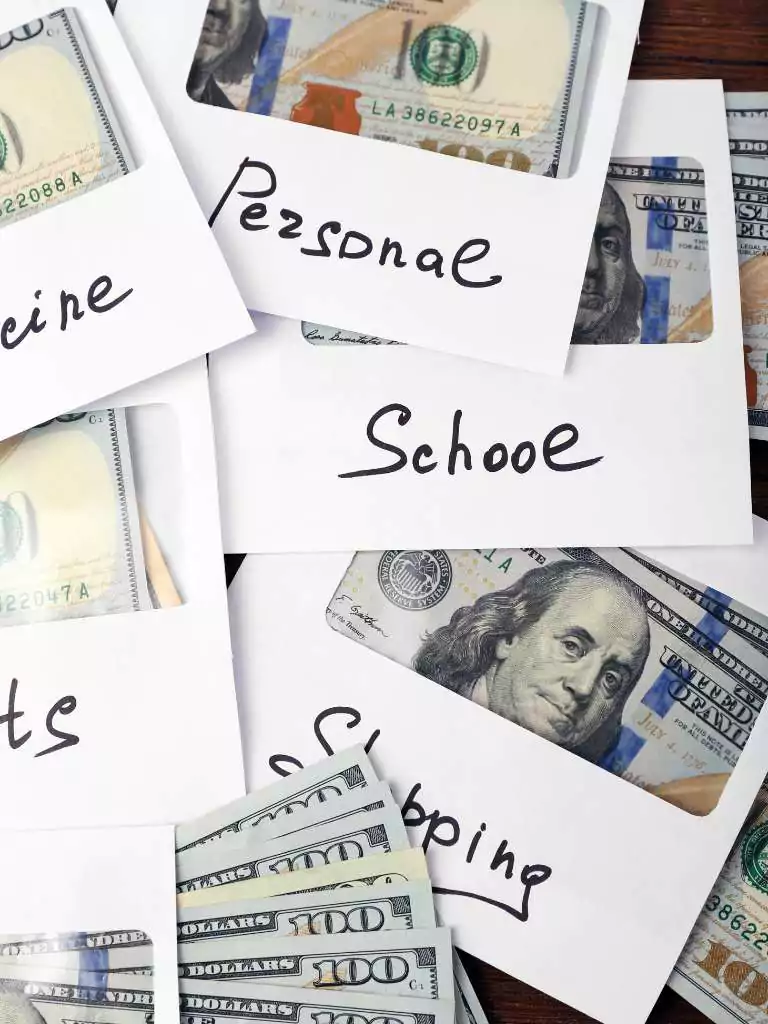

But it’s actually a super simple system where every dollar you earn gets a job—even if that job is “chilling in savings.” You subtract your expenses from your income until you hit zero (on paper, not in real life!).

Here’s how I make it less soul-crushing: I give my budget categories playful names like “Kid Chaos Fund” (aka groceries) or “Mama’s Sanity Stash” (coffee, duh).

Knowing exactly where my money is going helps me stay on track, and surprisingly, it’s kind of empowering. It turns your single mom income into a superhero tool—cape not included.

2. Automate the Boring Stuff (So You Can Focus on Surviving Mondays)

Life as a single parent doesn’t come with a pause button. And honestly, remembering to pay bills on time when you’re trying to find matching socks for three kids is…a lot.

That’s why automation is your new best friend.

Set up automatic payments for fixed bills—rent, utilities, even minimum credit card payments. It reduces late fees (goodbye, $35 surprises!) and clears up your mental space for things like meal planning or plotting your next mom side hustle.

Bonus: you’ll start to feel like you have your life together, even when you don’t.

3. Meal Plan Like a Budgeting Ninja

I used to hate meal planning. It felt too Type A for my chaotic Type C life. But then I realized I was throwing away both food and money every week.

Now I plan meals every Sunday using whatever’s in the fridge, what’s on sale, and what won’t cause a dinner-time riot.

It’s not about fancy Pinterest meals (although shoutout to single mom living boards for inspo)—it’s about saving cash and avoiding that evil moment when you order pizza for the third night in a row.

Stick to 2-3 base ingredients per week (hello, rice and beans), get creative, and yes, let cereal be dinner sometimes. It’s called balance.

4. Say Hello to Secondhand Everything

Thrift stores, Facebook Marketplace, hand-me-down groups—these are my happy places. I used to feel awkward about buying secondhand, but now? It’s like a treasure hunt.

Why spend $40 on a new pair of shoes for a 5-year-old who will outgrow them in a month?

Single mom finances don’t need to be stretched by keeping up appearances. Be the mom who proudly says, “Yup, it was $2 and still looks amazing.”

The earth thanks you, your budget thanks you, and your kids honestly don’t care as long as it sparkles or has dinosaurs on it.

5. Embrace the Magic of Free Fun

Kids don’t need expensive outings—they need attention and snacks. (Mostly snacks.) Some of our best memories came from library craft days, dollar store treasure hunts, or movie nights with popcorn and couch forts.

I started a little “Free Fun Jar” at home where the kids could pull ideas like “park picnic” or “dance party in the kitchen.” It keeps weekends exciting without draining my single parent budget.

Trust me, your kids will remember the laughs more than the price tag.

6. Start a Tiny, Mighty Emergency Fund

If the phrase “emergency fund” makes you roll your eyes because you can barely make it to payday—same. But I started with just $5 a week. That’s it. Five bucks. I called it my “Oh-Crap Fund” because, well… life.

Eventually, I built it up to $500 and let me tell you, the first time my car battery died and I didn’t panic? I felt like Beyoncé.

Even a small buffer gives you breathing room and helps you avoid credit card traps that destroy your financial stability. It’s like giving future-you a high five.

7. Monetize a Skill (Hello, Mom Side Hustle!)

I’m not about that hustle-till-you-drop culture, but a mom side hustle can be a game-changer. I started offering weekend babysitting and freelance writing gigs while the kids slept.

Think about what you already know how to do—crafting, baking, tutoring—and offer it locally or online.

There’s no shame in doing what you gotta do. Extra income means more options, fewer surprises, and maybe (just maybe) that overdue spa day. Plus, showing your kids how you work hard to build a better life? That’s superhero stuff.

Conclusion

Budgeting as a single parent isn’t easy—but it also isn’t impossible. You don’t need to cut out every joy in life just to make ends meet.

A few smart strategies, some creativity, and a healthy dose of humor can stretch your dollars and boost your confidence.

Remember, this isn’t about perfection. It’s about progress. Whether you’re tackling single mom income challenges or just trying to make that grocery budget last a little longer, you’re doing your best—and that’s more than enough.

Keep showing up. Keep laughing. And keep budgeting like the boss you are.